- Birdville Bonds

- Tax Rate Information

-

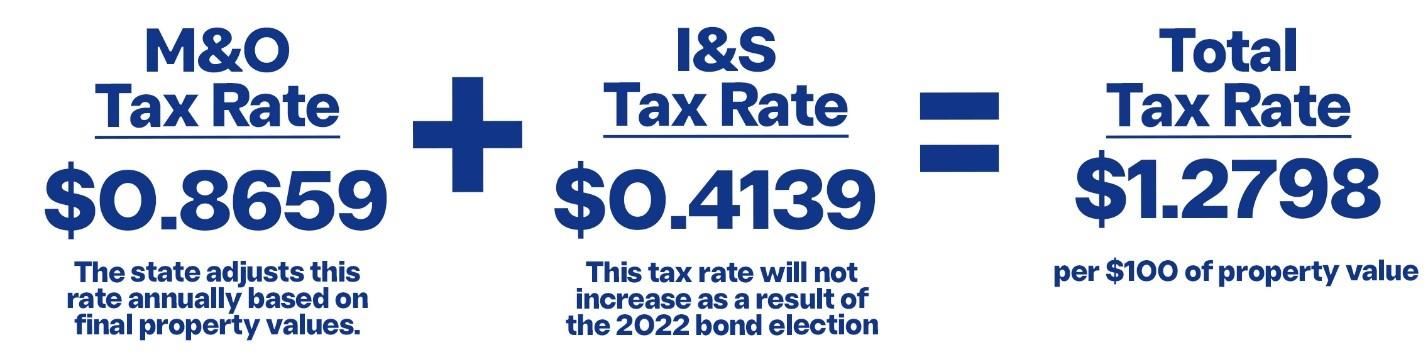

Birdville ISD Tax Rate

The Birdville ISD tax rate will not change as a result of the 2022 bond election.

The 2020–2021 total tax rate was $1.3803 per $100 of taxable value.

The 2021–2022 total tax rate was $1.3380 per $100 of taxable value.

The 2022–2023 total tax rate is $1.2798 per $100 of taxable value.

With the I&S rate at 41.39 cents, the District has been able to pay down existing debt at a faster rate, which has positioned the District to have additional bonding capacity now and in the future to address facility improvements. Since 2014, the Board has approved prepayments of $29 million of bond principal saving taxpayers more than $20.2 million in future interest payments.

About Public School Tax Rates

The first bucket is the Maintenance & Operations (M&O) budget, which funds daily costs and recurring expenditures such as teacher and staff salaries, supplies, insurance and utilities.

The second bucket is the Interest & Sinking (I&S) budget, also known as Debt Service, which is used to repay debt for capital improvements approved by voters through bond elections.

Proceeds from a bond issue can be used for the construction and renovation of facilities, the acquisition of land, and the purchase of capital items such as equipment, technology and transportation. By law, I&S funds cannot be used to pay M&O expenses which means that I&S funds cannot be used to pay teachers or pay for rising costs for utilities and services.

Additional Birdville ISD Tax Information

-

Homeowners Over 65

Birdville ISD property taxes for citizens age 65 or older will not be affected by this — or any — school bond election.

-

- The school district tax rate will not change for anyone as a result of this election.

- Citizens 65 & over are eligible for an “over 65” homestead tax ceiling.

> Visit Texas Comptroller's website for FAQs About Over 65 Exemptions

According to state law, the dollar amount of school taxes imposed on the residence homestead of a person 65 years of age or older cannot be increased above the amount paid in the first year after the person turned 65, regardless of changes in tax rate or property value unless significant improvements are made to the home. If you are 65 or older, you may file a homestead application at any time, or contact your local appraisal district to see if you already have the appropriate exemption on file.

-

-

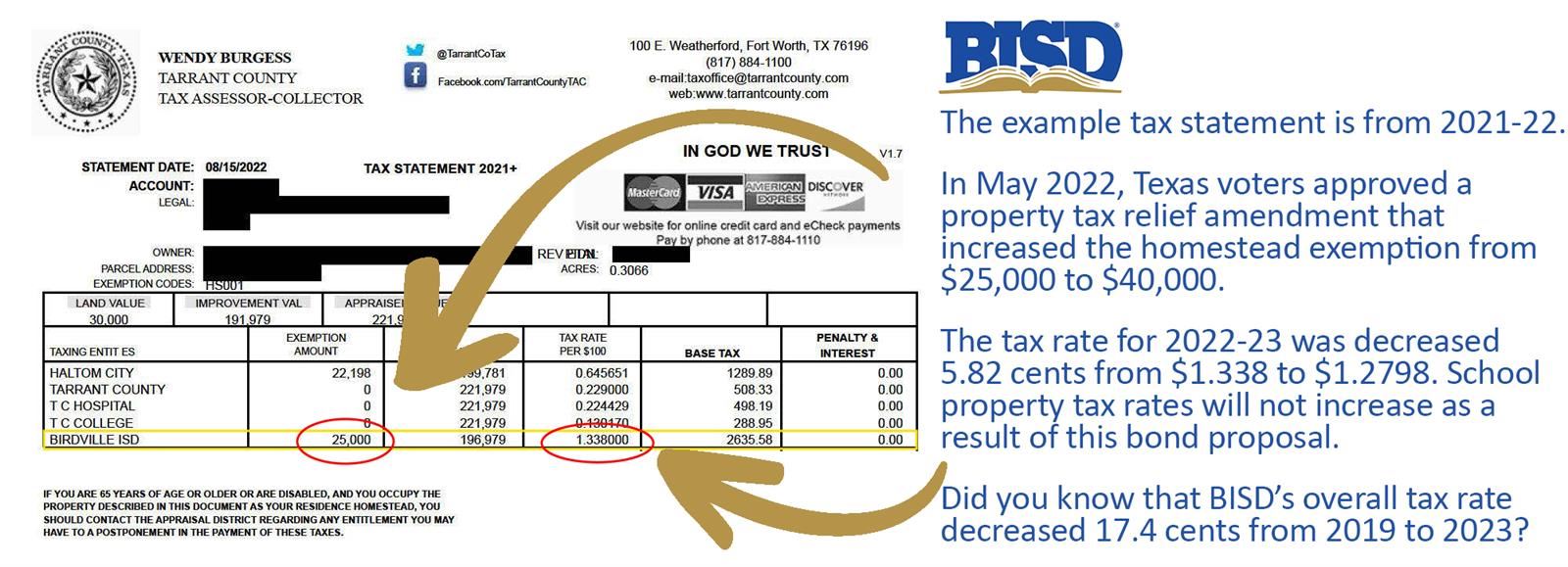

Understanding Your Tax Bill

The illustration below explains the Birdville ISD portions of your property tax statement.

-

- Based on the statewide voter approval constitutional amendment in May 2022, the homestead exemption was raised from $25,000 to $40,000. This change will be reflected on the 2022–23 tax bill.

- The tax rate shown on the statement is the total tax rate, combining the M&O and I&S portions of the rate. The tax rate will not increase as a result of the May 2022 bond election. In fact, the state will actually lower the M&O rate as part of their property tax relief, and the I&S rate will not increase if voters approve this bond.

- Based on the statewide voter approval constitutional amendment in May 2022, the homestead exemption was raised from $25,000 to $40,000. This change will be reflected on the 2022–23 tax bill.

-

-

The Facts about Higher Tax Bills

Your tax bill may be higher due to an increase in your property value, not an increase in the school district tax rate. Property appraisals are set by the county appraisal district, and home values have risen across our region.

-

Birdville ISD’s bond referendum will not increase the property tax rate for homeowners or businesses. However, a new state law requires all school bond referendum propositions to include ballot language that reads “THIS IS A PROPERTY TAX INCREASE.” Passage of the bond package will not result in an increase in the property tax rate, despite the ballot language stating that there will be a tax increase.